Tax Planning for Beginners: Tax Strategy Concepts to Know

Tax planning is the analysis and arrangement of a person’s financial situation in order to maximize tax breaks and minimize tax liabilities in a legal and efficient manner.

You can’t really plan for the future if you don’t know where you are today. So the first tax planning tip is get a grip on what federal tax bracket you’re in.

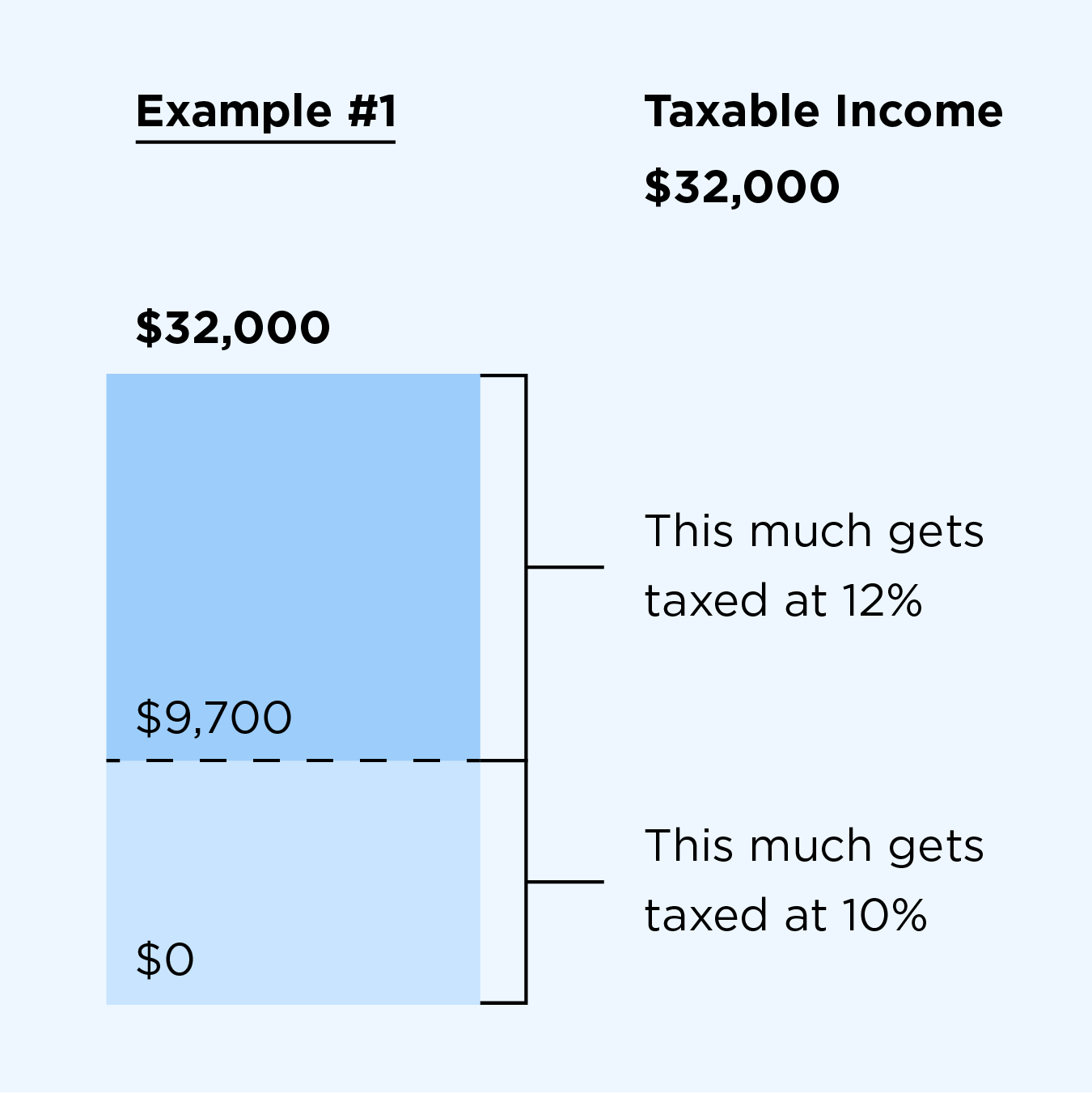

The United States has a progressive tax system. That means people with higher taxable incomes are subject to higher tax rates. People with lower taxable incomes are subject to lower tax rates.

There are seven federal income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

No matter which bracket you’re in, you probably won’t pay that rate on your entire income

For example, let’s say you’re a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket for the 2019 tax year. But do you pay 12% on all $32,000? No. Actually, you pay 10% on the first $9,700; then you pay 12% on the rest. If you had $50,000 of taxable income, you’d pay 10% on that first $9,700 and 12% on the chunk of income between $9,701 and $39,475. And then you’d pay 22% on the rest.

The difference between tax deductions and tax credits

Tax deductions and tax credits may be the best part of preparing your tax return. Both reduce your tax bill, but in very different ways. Knowing the difference can create some very effective tax strategies that reduce your tax bill.

What is the standard deduction?

Basically, it’s a flat-dollar, no-questions-asked tax deduction. Taking the standard deduction makes tax prep go a lot faster, which is probably a big reason why many taxpayers do it instead of itemizing.

How to Choose Your Tax Adviser or Accountant

Do I need a tax adviser or an accountant?

More often than not people will actually require both an accountant and a tax adviser, however, it is important to establish why you need them – do you need someone to manage your accounts and help you with your tax return? Or someone to give you sound advice that will legally save you money?

What does an accountant do?

Your accountant can manage your accounts, provide compliance work and some may even do tax planning.

What does a tax adviser do?

Tax advisers tend to focus solely on tax planning. They spend significant amounts of time keeping up-to-date with the latest tax legislation and tax cases to help make sure they provide their clients with great strategies that will help to reduce or eliminate tax – some of which your accountant may not even be aware of

Example of the difference between an accountant and tax adviser

If we compare the accountancy profession with medicine, an accountant is the equivalent of a GP, and most of the time a GP is all you need for routine health care, but if you get seriously ill (compare with a dispute with HM Revenue and Customs) or you need surgery (tax planning), then you need a specialist consultant (a Tax Adviser).

What qualifications should my Tax Adviser / Accountant have?

As a client you want to be assured that your tax adviser / accountant is acting in both your best interest and within the law, which is why it is important to know what qualifications your tax adviser or accountant has, and when they were achieved and if they are relevant to you. Check that the qualifications they have cover the area of taxation or accounting that you require assistance with.

How to Find a Good Tax Adviser

Many unlicensed tax preparers with questionable credentials set up shop during income-tax season. Some disappear after the April 15 filing date, leaving you to deal with the IRS if there’s a problem with your return. The IRS recently cracked down on such rogue tax preparers by, among other things, contacting those whose returns have frequently shown to have errors. Plus, it is instituting stricter rules for anyone who charges a fee to prepare a tax return. See the IRS’s fact sheets about the new requirements for tax-return preparers. Most of the new rules do not take effect until the 2011 tax season, so taxpayers still need to be vigilant when hiring a tax preparer or adviser this year.

One good approach is to look for an enrolled agent. Enrolled agents are tax experts who must pass a rigorous test, meet annual continuing-education requirements, and who are licensed to represent clients in front of the IRS. Enrolled agents can prepare your income-tax return, and some provide tax-planning advice. You can also contact an enrolled agent if you need help after receiving a penalty letter from the IRS.

Enrolled agents work in a variety of settings: Some have their own firms, some work for tax-preparation chains, and some are also certified public accountants or certified financial planners. You can find an enrolled agent through the National Association of Enrolled Agents

If you’re looking for help with financial planning as well as taxes, CPAs who are also personal financial specialists (CPA/PFS) can help integrate tax planning with investing, retirement-planning and estate issues. You can find a CPA/PFS

Tax Planning: The Good, the Bad, and the Ugly

When your clients come to you and wonder what they can do to save money when it comes to paying taxes, you can recommend tax planning services. Many taxpayers aren’t aware of how impactful tax planning can be.

Wise taxpayers plan out their upcoming tax year instead of hoping you can do something amazing for them once the year is over. Those that plan ahead have more control over their tax situation and increase their chances of reducing their tax obligations. It’s the first step toward a better financial future.

The Good: In-Person Tax Planning with a Professional

The best way for taxpayers to implement a workable tax plan is to meet with a professional. Like a doctor, tax preparers who offer tax planning services take time to look at their client’s financial health, then diagnose any areas where mistakes and poor planning actually cost them. It’s also a good way to look for any missed opportunities that the taxpayer may use in the future.

The Bad: Generic Tax Planning Software

If a client is not convinced that hiring you for formal tax planning is something they want to do, they might at least consider some do-it-yourself tax planning using specialized tax software. From data management software like Microsoft Excel to programs and apps designed to help individuals and small businesses with tax planning, using available tools is better than no tax planning at all.

The Ugly: Ineffective or Nonexistent Planning

The worst thing that an individual or small business can do with tax planning is not having a plan at all. These are the kinds of clients that keep paper receipts in shoe boxes or files in no real order. Even if you’ve explained to them how much they would benefit from tax planning, they still insist on a pen and paper method of managing their finances and fail to plan for the immediate future or any long-term goals.

Tips for Choosing a Tax Preparer

It’s the time of the year when many taxpayers choose a tax preparer to help file a tax return. These taxpayers should choose their tax return preparer wisely. This is because taxpayers are responsible for all the information on their income tax return. That’s true no matter who prepares the return.

Check the Preparer’s Qualifications. Use the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications. This tool helps taxpayers find a tax return preparer with specific qualifications. The directory is a searchable and sortable listing of preparers.

Check the Preparer’s History. Ask the Better Business Bureau about the preparer. Check for disciplinary actions and the license status for credentialed preparers. For CPAs, check with the State Board of Accountancy. For attorneys, check with the State Bar Association. For Enrolled Agents, go to the verify enrolled agent status page on IRS.gov or check the directory.

Ask about Service Fees. Avoid preparers who base fees on a percentage of the refund or who boast bigger refunds than their competition. When asking about a preparer’s services and fees, don’t give them tax documents, Social Security numbers or other information.

Ask to E-File. Taxpayers should make sure their preparer offers IRS e-file. The quickest way for taxpayers to get their refund is to electronically file their federal tax return and use direct deposit.

Make Sure the Preparer is Available. Taxpayers may want to contact their preparer after this year’s April 17 due date. Avoid fly-by-night preparers.